In the current competitive corporate environment, success is not solely dependent on sales volume, rather, it requires well-informed decision-making that maximizes both financial performance and sales tactics. It can be difficult for Magaya users to watch sales development in real time and manage their money without the proper tools. In order to help you drive growth, increase profitability, and improve processes throughout your entire firm, a Sales and Finance BI Dashboard can be of assistance.

Imagine having a single, simple-to-use dashboard that could watch cash flow, anticipate future sales success, monitor receivables, and visualize profit patterns. Doesn’t that sound strong? Let’s explore how Magaya users may uncover financial excellence and improve business performance by utilizing the Sales and Finance BI Dashboard.

The Need for Smarter Decision-Making in Sales and Finance

Managing a logistics or supply chain business means balancing countless financial and operational details. From tracking sales revenue to monitoring expenses, and from analyzing profit margins to understanding customer payment behaviors, staying on top of it all can quickly become overwhelming. And without real-time insights, making timely and effective decisions becomes even more challenging.

This is where a Sales and Finance BI Dashboard transforms how you view your data. By integrating Magaya ERP with a BI dashboard, you gain immediate access to clear, detailed, and actionable financial insights that help you make better, data-driven decisions. Let’s take a look at the powerful features and benefits that come with this tool.

1. Gain Comprehensive Financial Insights with the P&L Dashboard

One of the first things any business needs is a clear view of its financial health. The Management & IFRS P&L Dashboard provides Magaya users with a detailed look at profit and loss over specific periods. You can compare current performance with historical data and use customizable filters to focus on particular aspects of your business.

- This dashboard allows you to track key financial indicators, such as revenues, expenses, and net profit, all in one place.

- By drilling down into specific categories, you’ll gain insights into where you’re earning money, where costs are rising, and what you can do to improve your overall profitability.

- This level of granular financial visibility is crucial for making strategic decisions about budgeting, investing in growth, and cutting costs where needed.

The ability to make comparative analyses between different periods lets you evaluate seasonal trends and plan accordingly, ensuring that you never miss a beat in terms of financial health.

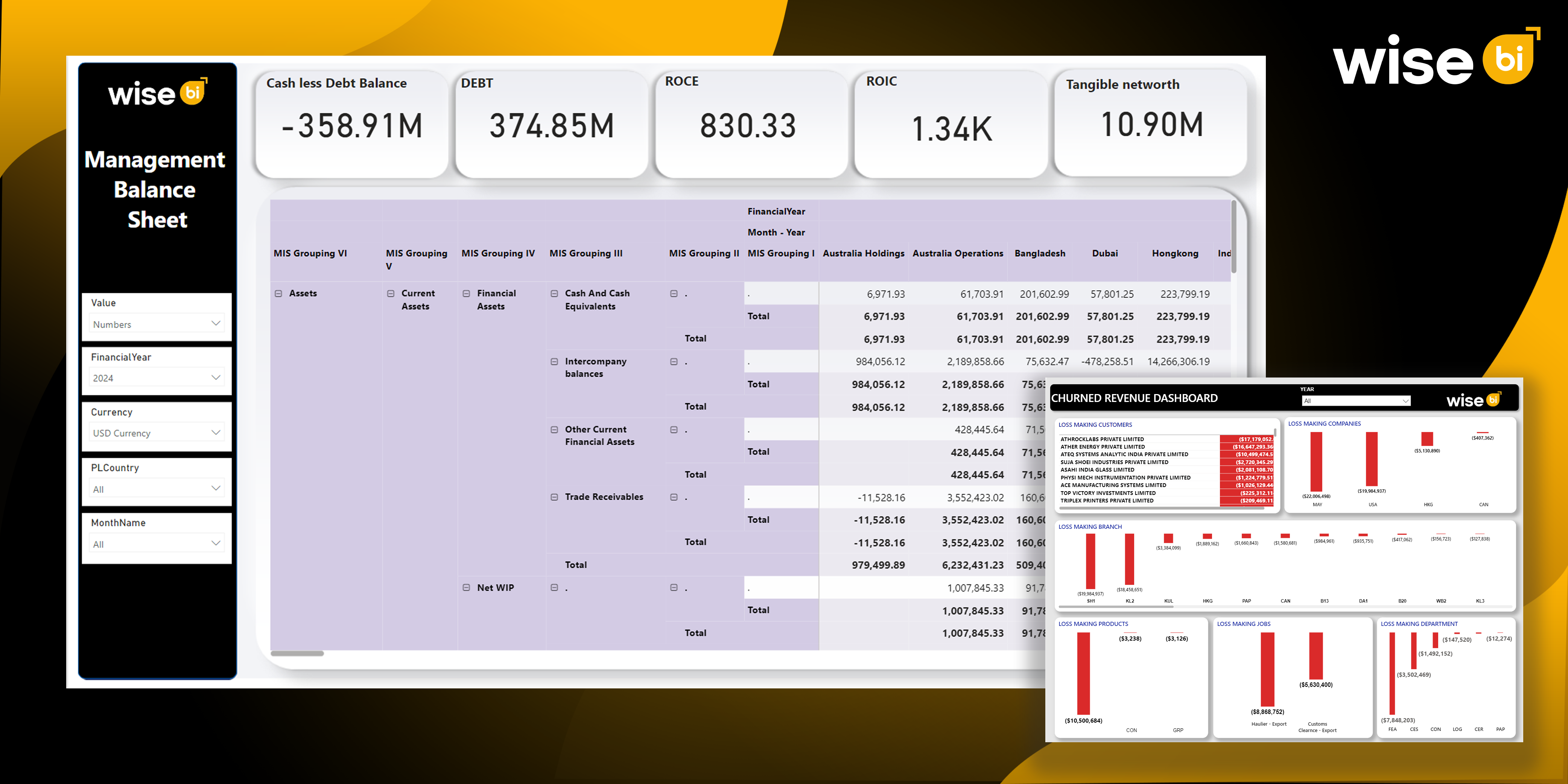

2. Track Assets and Liabilities with Balance Sheets

Understanding your company’s financial stability is essential for managing both day-to-day operations and long-term growth. The Management & IFRS Balance Sheets give Magaya users the ability to monitor key metrics like assets, liabilities, and cash flow.

- With this dashboard, you can track what you own (assets) versus what you owe (liabilities), giving you a holistic view of your financial position.

- This insight helps you manage liquidity, track debt ratios, and gauge whether you have enough assets to cover liabilities in the short and long term.

- Managing your balance sheet effectively means better cash flow control, which is critical for making operational decisions, investing in growth, and ensuring financial sustainability.

With real-time balance sheet insights, you’ll be able to make quick decisions on capital investments and debt management, keeping your financial health in check.

3. Optimize Profitability with the Profit Insights Dashboard

Sales growth is important, but profitability is the bottom line. The Profit Insights Dashboard is a powerful tool for tracking performance across different branches, products, and departments. This dashboard helps you identify your most profitable channels and understand where your resources are best allocated.

- Real-time insights into profit margins by customer, product type, and department.

- By understanding which areas of your business are most profitable, you can refine your sales strategies, focus on your top performers, and optimize resources across your organization.

- With this dashboard, you’ll be able to drive higher profitability by concentrating your efforts on the high-return areas of your business, while also identifying low-margin segments that need improvement.

Whether you’re a sales manager or CFO, these insights will help you prioritize your efforts and maximize returns on every sale.

4. Address Revenue Loss with the Churned Revenue Dashboard

Losing customers and revenue can seriously hinder your growth. The Churned Revenue Dashboard helps Magaya users focus on the underperforming areas of their business by tracking lost revenue and customer attrition.

- A deep dive into the revenue lost from customers who have stopped doing business with you, as well as identifying the root causes of churn.

- By analyzing this data, you’ll gain insights into why customers are leaving and which factors contribute most to their departure. This helps you take targeted actions to retain customers and optimize customer engagement.

- Customer retention is far less expensive than acquisition, and understanding your churn patterns allows you to create more effective retention strategies to reduce lost revenue and keep loyal customers coming back.

This dashboard provides an opportunity for proactive intervention, enabling you to strengthen customer relationships and enhance service quality.

5. Track Cash Flow and Receivables with Financial Overview

Managing your cash flow effectively is one of the most important tasks for ensuring business continuity. The Financial Overview Dashboard offers a comprehensive view of your cash flow, receivables, and expenses.

- A real-time look at income, expenses, and outstanding receivables to provide a holistic financial snapshot.

- This dashboard helps you stay on top of late payments, understand where cash is being tied up, and ensure that your business can cover its expenses without dipping into debt.

- Effective cash flow management is the lifeblood of any business. With the financial overview, you can make informed decisions about investments, expansion, and reducing outstanding payments.

By staying on top of your cash flow, you can avoid liquidity issues and keep your operations running smoothly.

Conclusion

For Magaya users, Sales and Finance BI Dashboards offer a powerful way to optimize profitability, drive sales growth, and improve operational performance. From tracking profitability across departments to managing cash flow and reducing churn, these dashboards provide real-time, actionable insights that help businesses make smarter decisions.

With tools like the Profit Insights Dashboard, Churned Revenue Dashboard, and Financial Overview, you can take control of your financial health, improve your sales strategies, and build more sustainable, profitable operations.

Are you prepared to realize the sales potential of your company? Contact us today to see how our Sales and Finance Dashboard can empower your Magaya ERP system with the insights needed to grow, optimize, and thrive.